Under national health reform, new federal rules will govern the nongroup and small-group health insurance markets, including a requirement for state-based health insurance exchanges, or marketplaces, to be operational by Jan. 1, 2014. Between now and then, both the federal government and states must make key decisions about the design and operation of the exchanges. This Policy Analysis examines five design decisions that federal and state governments will face related to the degree of benefit and premium standardization of health insurance products sold in the exchanges. Within broad federal guidelines, states inevitably will make different policy decisions, but all states will face a similar set of trade-offs. The most basic trade-off is between simplicity and flexibility—a highly standardized health insurance market simplifies the consumer shopping experience and intensifies insurer competition but limits insurers’ flexibility to develop innovative products. While these policy decisions involve fairly arcane concepts—such as quantifying the actuarial value, or comprehensiveness—of coverage—the overarching question for federal and state policy makers is straightforward: How can the exchanges promote healthy competition among insurers to provide better health care at lower total cost?

- Managed Competition Takes the Stage

- Health Plan Standardization

- Key Design Questions

- Moving Managed Competition into Practice

- Notes

Managed Competition Takes the Stage

The Patient Protection and Affordable Care Act (PPACA) of 20101 takes the concept of managed competition, long championed by Alain Enthoven and others, and puts it into practice in the nongroup and small-group health insurance markets in 2014.2 At the center of the managed competition model is a “sponsor” whose key duty is to establish rules designed to promote healthy competition among insurers.

Employers offering health insurance act as sponsors—they select which plan or plans to offer, they help employees enroll, they collect and pay premiums, and they usually subsidize coverage by contributing to premium costs. PPACA requires that states have a health insurance exchange in operation on Jan. 1, 2014, that will play the role of sponsor for individuals without access to health insurance through an employer. Small businesses, initially those with 100 or fewer workers, also will be able to offer health coverage to their employees through the exchanges, essentially having the exchange take on the role of sponsor.

The guiding principle of managed competition is that competition among health insurers can be healthy or unhealthy, depending on the marketplace structure and the rules of the road. Healthy competition consists of insurer efforts to increase value for policyholders by producing better health outcomes at lower total cost. Unhealthy competition consists of insurer efforts to avoid insuring sicker people, to confuse policyholders or to avoid paying legitimate claims.

The key elements of PPACA’s managed-competition model include: access to health insurance regardless of health status; income-based, fixed-dollar subsidies to help ensure that people can afford at least a basic plan; and some standardization of plan design to foster informed choice by consumers and make the market more competitive.

Under PPACA, states will have a great deal of flexibility in designing their exchanges. The options available to states lie on a spectrum. The so-called clearinghouse model is at the less-regulated end of the spectrum—under this model, states would allow any insurance product that meets the minimum federal requirements to be offered in the exchange. At the more-regulated end of the spectrum is the so-called active-purchaser model, in which states would choose whether or not to allow insurers to offer certain products and would establish rules beyond the federal floor. The policy questions and options described in this analysis are relevant to states choosing among different degrees of the active-purchaser model.

Health Plan Standardization

Standardization refers to constraints on health insurance product design that result in competing insurers’ products, or plans, being similar to each other or even identical in certain respects. The individual Medicare supplemental, or Medigap, market is an example of a highly standardized market—insurers are only permitted to sell up to 12 types of plans. Each plan type is labeled uniformly (“A,” “B,” etc.), and each has specified cost-sharing features detailed in law.

Two questions immediately arise: Why should there be any standardization of plans at all, and what is the minimum degree of standardization required by PPACA?

Why Standardize?

In most consumer product markets, innovation and product differentiation are the hallmarks of a healthy market. Why should health insurance be different? There are at least three rationales for standardizing plan designs in the new health insurance exchanges: promoting price competition, preventing favorable selection by some plans through designs that would encourage healthy people to enroll, and determining which plans qualify for subsidies and satisfy the individual mandate for coverage.

Promoting price competition. In a well-functioning consumer product market, buyers can easily assess the quality, price and features of the available products and quickly make a well-informed choice. In that type of market, overpriced or inferior products will quickly be driven out. Health insurance markets diverge from this ideal because of the complexity of the product being sold. Competing health plans can differ from each other in countless ways, some of which are relatively straightforward to assess before purchasing—for example, the deductible—while others are more difficult to assess—provider network breadth—and still others are nearly impossible to assess—the stringency of utilization management.

In markets where consumers have difficulties directly assessing the quality of competing products, two negative consequences arise. The first is an undermining of the role of price competition—instead of consumers trading off price and quality, some consumers will choose the lowest-priced product, some will choose randomly and others will rely on a seller’s reputation. The second is the risk of unpleasant surprises, where the buyer learns the limits of the product only after buying. Standardization can help promote price competition by reducing the number of dimensions on which plans can differ, simplifying comparisons among plans and helping guarantee that all plans meet minimum standards.

Preventing plan designs that selectively appeal to healthy people. Health insurance markets are unusual in the degree to which sellers’ costs and profits depend on exactly who chooses to buy their product. A toothpaste manufacturer cares little who is buying its product, while a health insurer’s financial success depends keenly on who enrolls and, more specifically, whether enrollees are healthy or sick and how inclined they are to use medical care.

A health plan that, for example, includes free gym memberships but does not cover diabetic testing supplies would tend to attract healthier people. The pressure on insurers to use plan designs to attract healthier enrollees will be stronger in cases where insurers are not permitted to deny enrollment, limit coverage for pre-existing conditions or vary premiums based on health status. Starting in 2014, PPACA will apply those standards in the nongroup and small-group markets, so insurers’ attempts to achieve favorable selection will be a concern.3

Standardization of health plans—for example, requiring all health plans to cover diabetic testing supplies and banning gym memberships—limits insurers’ latitude to appeal selectively to healthy individuals. Standardization can help avoid a race to the bottom where insurers compete to enroll healthy individuals by dropping coverage for a broader and broader set of services. There are trade-offs, however—individuals want and value different benefits, and offering free gym memberships, for example, could be socially worthwhile if it leads to improved fitness and better health.

Determining which plans are eligible for subsidies and satisfy the individual mandate. Starting in 2014, low-income people will be eligible for subsidies for nongroup plans purchased through the exchanges, and almost all people will be mandated to have health insurance. The subsidies and the mandate both require some set of minimum standards or floors to determine whether individuals have purchased an insurance product eligible for subsidies and whether they have satisfied the mandate. The floors will result in some degree of plan standardization.

How Much Standardization Does PPACA Require?

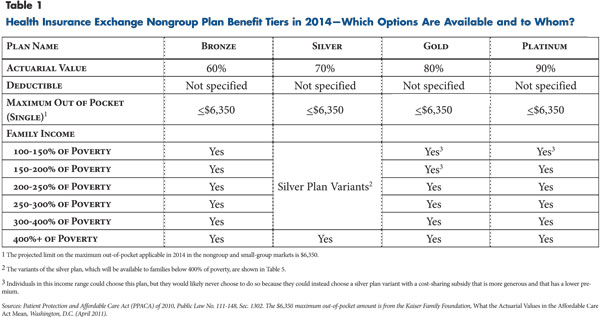

Under PPACA, all new health plans sold in the nongroup and small-group markets beginning in 2014 will be required to cover so-called essential health benefits, and they will be required to fit into one of four cost-sharing tiers (see Table 1). The four basic cost-sharing tiers are defined based on actuarial value, which is a measure of the generosity of a health plan equal to the average share of covered benefits paid by the insurer for a standard population (see box below for more about calculating actuarial value). Actuarial values are set at 60 percent for bronze plans, 70 percent for silver, 80 percent for gold and 90 percent for platinum. In addition, a catastrophic high-deductible plan may be available to certain individuals.4

Many of the details in PPACA, including the definitions of essential health benefits and actuarial value, were left to the U.S. Department of Health and Human Services (HHS) to define in regulation. HHS has released several proposed rules relating to the exchanges but has not yet released a proposed definition of essential health benefits or a methodology for the calculation of actuarial value. Based on the proposed rules issued so far, HHS may develop a default set of federal standards but allow states the flexibility to use different standards.

Standardization of plans is one of a larger set of mechanisms in PPACA designed to address and minimize selection pressures in the exchanges. The need for standardization will depend in part on the effectiveness of these other mechanisms, and vice versa. These mechanisms include:

- a risk-adjustment process that will transfer funds from plans that disproportionately enroll healthy people to plans that disproportionately enroll sicker people;

- an explicit prohibition on “marketing practices or benefit designs that have the effect of discouraging the enrollment in such plan by individuals with significant health needs;”5

- a temporary reinsurance program that will transfer funds to insurers that enroll sick individuals when the exchanges first open;

- a temporary risk corridor program that will partially reimburse insurers with large financial losses and partially recoup large financial gains; and

- the individual mandate and associated penalties, which are designed to help ensure that healthy individuals participate in the exchanges.

It is important to point out that there are many important plan features that are not required to be standardized under PPACA. These features include the breadth and type of providers included in the plan network, the payment rates and payment methods that the plan uses to pay providers, and the use of utilization management, such as prior authorization. Even if exchange plans cannot vary cost-sharing features, they would still be competing on the basis of other features.

How is Actuarial Value Defined?

Actuarial value is a measure of the comprehensiveness of a health insurance plan. Actuarial value is calculated as follows.

1. Construct a database that contains the projected claims experience for a large population of insured individuals

2. Define the covered benefits and cost-sharing features of the health plan (e.g., what is the deductible? what is the coinsurance rate?).

3. Using the projected claims database, calculate the following two amounts:

A: The amount paid by the insurer for covered benefits.

B: The amount that would be paid by the policy holder for covered benefits.

4. A+B = Total spending on covered benefits (i.e., the “actuarial scope of benefits”). (Non-covered benefits do not enter into the calculation of actuarial value.)

5. Actuarial value = A/(A+B)

Source: Author’s analysis

Key Design Questions

As federal and state policy makers move forward with implementing the state-based health insurance exchanges, they will face many important questions about the design and operation of the exchanges, including:

- How much latitude should insurers have in designing cost-sharing features?

- How to define the standard population to calculate actuarial value?

- Should states regulate relative premiums?

- How should exchanges implement out-of-pocket limits for families with income between 250 percent and 400 percent of the federal poverty level?

- Should variation in the scope of covered benefits be reflected in actuarial value?

Latitude in Cost-Sharing Features

Context. Cost sharing refers to amounts paid by patients for covered medical care at the point of service, including deductibles, coinsurance and copayments, but not premiums. Starting in 2014, PPACA specifies that all new plans sold in the nongroup and small-group markets must fall into one of four actuarial-value tiers and have an out-of-pocket maximum—or limit on cost sharing. The cost-sharing limit is tied to the out-of-pocket maximum for health savings accounts—$5,950 for single coverage in 2011 and projected to be $6,350 in 2014.6

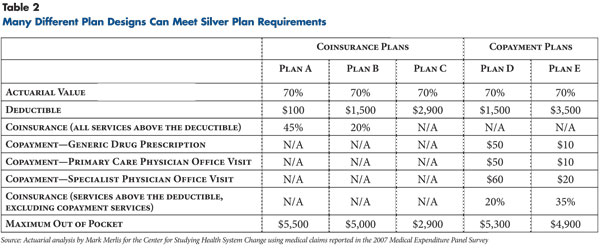

Within a given benefit tier, a wide range of cost-sharing designs could meet the actuarial value requirements. Five hypothetical silver plan designs, each with a 70 percent actuarial value and an out-of-pocket maximum within the limit could vary widely (see Table 2 for a description of the hypothetical silver plans). In the hypothetical plans, the deductibles range from $100 to $2,900, the prescription drug copayments range from $10 to $50, and so on. One of the plans is a deductible-only plan, meaning that its deductible is equal to its out-of-pocket maximum—both are $2,900.

To choose intelligently among such plans, an individual would need to understand, for example, the difference between coinsurance—a percentage of the cost of care—and copayments—a fixed dollar amount for a service—and have some sense of their possible health care costs in the coming year. Even more-complex plan features that a consumer would have to consider include multiple-tiered prescription drug copayments; which providers are in the network; the magnitude of balance billing for services by providers outside the network; individual vs. family deductibles and maximum out-of-pocket limits; and so on.

The Medicare Part D program, which offers subsidized private prescription drug plans to beneficiaries, offers a number of useful insights. Insurers are allowed to offer a wide range of Part D plans as long as the plans meet a minimum actuarial-value requirement. Research shows consumers appreciate having a choice of insurers, but it is clearly unpleasant for consumers to have to choose among a very large number of plan designs. In 2006, 70 percent of elderly Medicare beneficiaries reported that “there were too many alternative [Part D] plans to choose from.”7 And, in a separate survey of elderly Medicare beneficiaries, 60 percent reported agreeing that “Medicare should select a handful of plans that meet certain standards so seniors will have an easier time choosing.”8 It is also fairly clear why choosing a Part D plan is unpleasant. Most seniors do not understand the basic features of the plans they have chosen—for example, whether the plan they are enrolled in has a coverage gap, or “donut hole,”9 and they only rarely choose the plan that minimizes their out-of-pocket costs.10

But, beyond mere unpleasantness, the impact of having a wide range of plans available is less clear. Although some seniors reported not enrolling in Part D because of confusion, overall take up of Part D is relatively high.11 One side effect of a confusingly wide array of plans may be an increased role for reputation in decision making—this could account for the dominant market share of the AARP-endorsed UnitedHealthcare Part D plan.12 Standardization of exchange plans might reduce the importance of reputation and increase the importance of premium costs, but it seems unlikely that reputation would play no role whatsoever. In the Medigap market, even though it is highly standardized, reputation—specifically, the AARP endorsement—plays a major role in plan choice.13

The availability of many different plan designs within a tier also makes it possible that some plans will disproportionately appeal to the healthy and others will disproportionately appeal to the sick. People who are fairly certain they will have high health spending in the coming year would gravitate toward plan designs with lower out-of-pocket maximums. And, people who are fairly certain they will only visit the doctor once or twice would probably prefer a plan with modest physician-visit copayments. In theory, risk adjustment can help offset some of the selection that occurs, but risk adjustment is an imperfect mechanism and may not be powerful enough to offset strong selection among plans with distinct designs.

Options. The range of regulatory options available to states will depend on the yet-to-be-released federal regulations. States will likely have the option of allowing insurers to use whatever plan design they choose, as long as it meets the actuarial-value and maximum out-of-pocket requirements. States also could impose a limited set of restrictions on plan design—for example, the out-of-pocket maximum for all silver plans must equal $5,000—while leaving other design issues up to insurers. Or, states could specify in detail the cost-sharing features for each of the plan tiers, similar to the Medigap market—for example, all silver plans must have a deductible of $1,500, coinsurance of 20 percent above the deductible and an out-of-pocket maximum of $5,000. If a state chooses to specify cost-sharing features, it would have to ensure that they conform to the actuarial-value requirements in the exchange.

Trade-offs. Standardization of cost sharing would have two positive effects. First, it would simplify consumer comparison shopping and likely intensify price competition among insurers. Plans would still compete for enrollees on the basis of premiums, reputation and their provider network but not on the basis of their cost-sharing design. Second, standardization of cost sharing could help reduce health-based selection and the possibility that a given insurer ends up with a much sicker-than-average group of enrollees. As the American Academy of Actuaries has noted, “The more similar the plan design features are, the less concern there will be about adverse selection between plans.”14

The downside to cost-sharing standardization is that it would prevent insurers from developing innovative cost-sharing arrangements, and it would limit options available to individuals. An example of an innovative approach that has received positive attention is value-based insurance design, in which patient cost-sharing is selectively reduced for services with proven clinical value.15 Standardization of cost sharing could, depending on how bluntly it is implemented, also inhibit the development of tiered-provider networks, which vary patient cost sharing depending on whether hospitals and physicians are in a more- vs. less-preferred tier.

Defining the Standard Population to Calculate Actuarial Value

Context: When an actuary calculates a health plan’s actuarial value, the actuary applies the plan’s cost-sharing features to the medical claims of a so-called standard population. That exercise measures a hypothetical: what percentage of costs would the plan cover if the standard population were enrolled in the plan. To be clear, the standard population is not an identifiable group of real people, it is instead a database of projected medical claims that is constructed and used in actuarial calculations.16

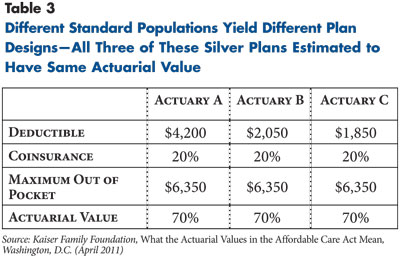

The actuarial value assigned to a plan depends on the plan’s cost-sharing features, the plan’s provider payment rates and the projected medical claims of the standard population. If, for example, the medical claims of the standard population are unusually skewed toward a small number of high-cost enrollees, then actuarial values calculated from that standard population will be relatively high. The projected rate of health care spending growth also matters—holding cost sharing constant, assuming a higher rate of spending growth will tend to increase the actuarial value assigned to a given plan.

A recent Kaiser Family Foundation (KFF) study illustrates the potential for plan designs to vary because of the use of different standard populations (see Table 3). KFF commissioned three well-respected actuarial firms to design health plans that would meet the actuarial-value requirements in the exchanges. In the KFF analysis, three of the silver plans all had identical actuarial value (70%), out-of-pocket maximums ($6,350) and coinsurance rates (20%). Because the three actuarial firms used different standard populations in their calculations, the plans vary widely in their deductibles, from a low of $1,850 to a high of $4,200.

PPACA specifies that the actuarial value of exchange plans be calculated based on the cost of benefits “provided to a standard population (and without regard to the population the plan may actually provide benefits to).”17 Either HHS will define what constitutes a standard population or leave it to the states.

Options. The American Academy of Actuaries recently identified two broad options for defining the standard population:18

- “use a common standardized dataset for all plans;” or

- “allow plans to use their own data, normalized with risk scores, to better reflect spending for a standard population.”

Trade-offs. Allowing insurers to define their own standard populations would allow them to tailor their actuarial calculations based on their actual provider payment rates, the breadth of their network and their enrollees’ utilization patterns. And, giving insurers flexibility on this dimension might encourage—or at least not discourage—their participation in the exchanges.

But, allowing insurers to define their own standard populations has several downsides. First, it would lead to wide variation in benefit designs within a tier, undermining standardization and price competition. Second, allowing insurers to define their own standard population gives them opportunities for strategic gaming. For example, if an insurer wanted to undercut competitors’ premiums, the insurer could skew its calculation of actuarial value in such a way that its plans would be less generous and its premiums lower than other insurers’ plans in the same tier. Other more subtle gaming is possible, such as an insurer skewing offerings to make its bronze plan relatively more attractive and its silver plan relatively less attractive.

Giving states free rein to define the standard population would permit experimentation and allow states to choose approaches building on their regulatory history and market conditions. There is some risk, however, that states, if given the freedom to do so, could define the standard population in a way that exchange plans end up paying a greater share of covered benefits than intended by law. States might choose to do this because the exchange subsidies are tied to the premium for the silver plan, which means that increasing the effective generosity of the silver plan would extract larger-than-intended exchange subsidies from the federal treasury.

HHS, or individual states, could construct the standard population claims database and provide it to insurers. This approach would involve some fairly intensive analytical work, but it has three advantages. First, the use of a common standardized dataset could help ensure that plans offered by different insurers within a given tier would have similar cost-sharing levels, which would intensify price competition. Second, the construction of a standard population is an expensive endeavor—rather than have teams of actuaries working for every insurer in every state, that task could be performed centrally with the results shared widely. Third, using a common standard population would simplify the process of verifying that insurers’ plan designs meet the actuarial-value requirements—this would lessen the enforcement burden on states and could improve the predictability of the process insurers go through to be certified as eligible to offer products in the exchange.

Regulating Relative Premiums

Context. Relative premiums refer to the relationship among the premiums that a given insurer charges for different plans in different benefit tiers—how much higher, for example, an insurer’s silver premium is compared to its bronze premium. The law clearly requires exchanges to monitor premiums and to take premiums into account when determining whether a plan is offered in the exchange.19 But, insurers will not just be charging one premium, they will be charging different premiums for different plans.

One might expect that the premiums insurers charge for plans in different tiers would be proportional to their actuarial value—for example, the silver premium would equal 117 percent of the bronze premium (70%-60%), and the gold premium would equal 114 percent of the silver premium (80%-70%), and so on. But there are at least three factors that, in the absence of regulation, would tend to push plans’ relative premiums away from their relative actuarial values: health-based selection, cost-sharing subsidies tied to enrollment in the silver plan and the utilization effect of cost sharing.

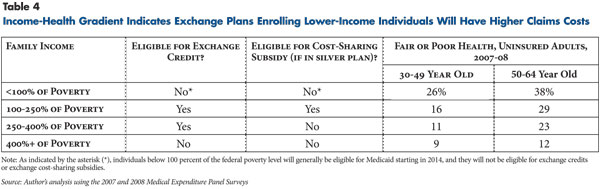

Health-based selection refers to the fact that older and sicker individuals tend to purchase more-comprehensive coverage. That phenomenon appears clearly in a survey of enrollees in Commonwealth Choice, the Massachusetts exchange for those with incomes too high to receive subsidies. Among enrollees in the bronze tier, only 4 percent reported being in fair or poor health, while in the gold tier, 22 percent reported fair or poor health.20 If there is no regulation of relative premiums, that type of health-based selection would result in premium differences between more- and less-generous plans far in excess of actuarial-value differences.

In the absence of any regulation of relative premiums, healthier individuals could end up paying a lower premium because they are being pooled with other healthy individuals, and sicker individuals could end up paying a higher premium because they are being pooled with other sicker individuals. That type of selection also creates the risk of a so-called death spiral, where all but the very sickest individuals leave the more-generous plan and the premium for the more-generous plan rises unsustainably. In the exchanges, the risk-adjustment mechanism is designed to prevent that type of spiral, but it is possible that risk adjustment will be inadequate to prevent it.21

Cost-sharing subsidies under PPACA are only available to families below 250 percent of the federal poverty level, or $55,875 for a family of four in 2011, and subsidies are only available for enrollees in silver plans. Individuals in lower-income groups tend to be in worse health than individuals in higher-income groups (see Table 4). Therefore, enrollees in the silver plan will probably be in worse health on average than enrollees in other tiers, which could increase the silver plan premium relative to the premiums for plans in the other tiers. One analysis suggests that enrollees in the silver tier, because enrollment in that tier is tied to receiving cost-sharing subsidies, could be substantially sicker than enrollees in the other tiers.22

The utilization effect of cost sharing also could affect relative premiums. All else being equal, individuals facing less cost sharing will tend to use more health care services than individuals facing higher cost sharing. Plans with higher actuarial values will likely have higher claims costs because of this utilization effect, which will tend to increase the premiums that insurers charge for more-generous plans.

It is unclear whether the law requires that relative premiums be proportional to actuarial value. The law states, “A health insurance issuer shall consider all enrollees in all health plans (other than grandfathered health plans) offered by such issuer in the individual market, including those enrollees who do not enroll in such plans through the Exchange, to be members of a single risk pool.” One interpretation of the single risk pool provision is that it requires an insurer charge relative premiums for plans in different tiers that are proportional to their actuarial value. Another, narrower, interpretation is that the provision is simply requiring that exchange plans be made available outside the exchange at the same premium as inside the exchange. A third possible interpretation is that it is defining the unit of analysis for the calculation of risk-adjustment and risk-corridor payments. HHS, presumably, will clarify the interpretation of this provision in an upcoming regulation.

Relative premiums matter for policy makers for at least two reasons. First, if there is no regulation of relative premiums, many sicker individuals will likely end up paying higher premiums because they tend to enroll in plans with other sicker individuals—that type of selection works against one of the clear aims of PPACA, which is to reduce the premium burden faced by sicker individuals. Second, federal exchange subsidies are tied to the second-lowest premium for a silver plan—regulations that reduce silver plan premiums and increase premiums for other plans will tend to reduce federal outlays for exchange subsidies.

Options. The simplest option, from a regulatory standpoint, would be to allow insurers to set whatever relative premiums they like. A second option would be to require that an insurer’s premiums at least be ordered—the premium for an insurer’s silver plan must exceed the premium for that insurer’s bronze plan, gold must exceed silver and so on. The third option is to allow some band of variation. For example, given that the actuarial value of the gold plan exceeds the silver plan by 14 percent, the exchange could allow relative premiums to differ by between 10 percent and 20 percent. The most-restrictive option would require insurers to charge premiums in fixed ratios—for example, the gold premium must exceed the silver premium by 14 percent and so on. These fixed ratios could incorporate a utilization factor to account for increased use of services in the higher tiers or not.

Trade-offs. Requiring an insurer to charge relative premiums for different plans proportional to each plan’s actuarial value would restrict one of the insurer’s key decisions—setting premiums—which could discourage insurer participation in the exchange. Requiring proportional premiums also makes it likely that at least one of the tiers will be a money-loser, or generate premiums inadequate to cover the costs of the enrollees in that tier. If one of the tiers is a perpetual money-loser, insurers might choose not to offer plans in that tier. If insurers do offer plans in a perpetual money-losing tier, the risk-adjustment system would have to be relied upon to redistribute funds to insurers offering those plans.

The upside of requiring proportional premiums is that it is consistent with two of the core goals of PPACA’s insurance market regulations. The first goal is for premiums to vary based on plan generosity but not based on an individual’s health status. In the absence of any regulation of relative premiums, the premiums in different benefit tiers will in part reflect the relative health of the enrollees in that tier, which allows a back-door form of health-based premium rating. The second goal is for individuals in the nongroup market to have a range of plans available to them. Requiring that premiums be proportional to actuarial value could short-circuit premium spirals and help maintain the availability of the gold and platinum plans, which would give consumers more choice of plans.23

Out-of-Pocket Limits for Lower-Middle-Income Families

Context. The health reform law reflects a series of compromises made amidst intense and conflicting pressures. One of the most obvious conflicts policy makers faced was between the goal of limiting low-to-middle-income families’ out-of-pocket liabilities and the need to limit gross federal subsidy costs. Those conflicting priorities are reflected in the law’s provisions related to cost-sharing subsidies and out-of-pocket limits in the exchanges.

Beginning in 2014, PPACA imposes a number of new limitations on cost sharing in the nongroup and small-group markets. The first two limitations, which have already been mentioned, are that plans must fall into one of the actuarial-value tiers and have out-of-pocket limits no higher than health savings accounts—$5,950 in 2011 for a single plan, $11,900 for a family plan. The third limitation is that silver plans must reduce the out-of-pocket limits for any plan enrollees with family income below 400 percent of the federal poverty level. In practice, this likely will mean that the exchanges will make some projection of an individual’s income in the coming year and then create a customized menu of plan choices based on the individual’s projected income. Under PPACA, for families between 300 percent and 400 percent of the federal poverty level (FPL), the silver plan out-of-pocket limit must be reduced by one-third, for families between 200 percent and 300 percent of FPL by one-half, and for families between 100 percent and 200 percent of FPL by two-thirds.

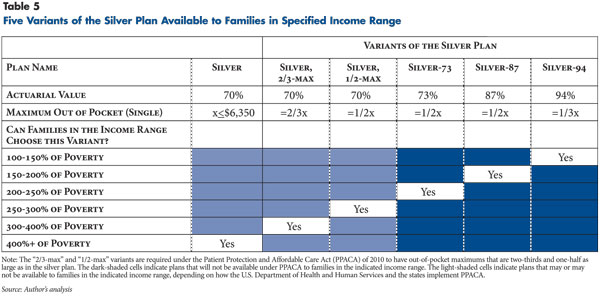

For silver-plan enrollees below 250 percent of the federal poverty level, PPACA provides subsidies to the insurer to increase the actuarial value of the silver plan—to 73 percent for people with family income between 200 percent and 250 percent of poverty; 87 percent for those with income between 150 percent and 200 percent of poverty; and 94 percent for people with family income between 100 percent and 150 percent of poverty. But, for silver-plan enrollees between 250 percent and 400 percent of poverty, the actuarial value of the silver plan must remain at 70 percent even while the out-of-pocket limit is reduced.

The combination of the required reductions in out-of-pocket limits and the limited availability of cost-sharing subsidies has two consequences. First, instead of insurers offering one silver plan, it appears that they will have to offer one basic silver plan plus five variants of that basic plan, each with a different combination of actuarial value and out-of-pocket maximums (see Table 5). Second, families between 250 percent and 400 percent of poverty who want to enroll in a silver plan could be limited to enrolling in a high-deductible version of the silver plan. For example, suppose there is an insurer offering a silver plan with a low deductible and a high out-of-pocket limit. If a family between 250 percent and 300 percent of poverty enrolls in that silver plan, PPACA requires the exchange to notify the insurer that the family is in that income range, and the insurer is then required to adjust the plan’s cost sharing so that the maximum out-of-pocket limit is reduced by half while keeping the actuarial value at 70 percent. The most obvious way for the insurer to meet those requirements would be to change a low-deductible, high-maximum-out-of-pocket plan into a high-deductible plan.

Options. The first option would be either to strike, or not enforce, the language that relates to cost sharing in the silver plan for families between 250 percent and 400 percent of poverty. Under this option, insurers would not be required to offer the variants of the silver plan with the reduced out-of-pocket maximum, and families in that income range would not be required to enroll in those variants. It is unclear whether HHS could provide guidance indicating that nonenforcement is acceptable. If a modification of the law is necessary, the minimally invasive approach would be to eliminate the reduced out-of-pocket limits as they apply to individuals above 250 percent of poverty. Another possible modification of the law would be to remove all of the language relating to reductions in out-of-pocket maximums. A second option is to require insurers to develop the five variants of the silver plan but allow individuals to enroll in any variant they choose. A third option is to enforce the cost-sharing requirements in PPACA as written, which means requiring insurers to define five variants of the silver plan and limit enrollment in the different versions to those in specified income ranges. There is also a fourth option, which is to define actuarial value in such a way that it is possible for an insurer to reduce the silver plan’s out-of-pocket maximum without increasing the deductible or other forms of cost sharing. This would require actuarial value to be defined in a way that expansions in the scope or extent of covered benefits are reflected in the calculation of actuarial value.

Trade-offs. In terms of complexity, requiring insurers to develop multiple versions of their silver plan complicates exchange operations for both insurers and consumers. But, insurers will clearly have to develop three variants of the silver plan (silver-73, silver-87 and silver-94) to provide the cost-sharing subsidies to families below 250 percent of the federal poverty level. Requiring insurers to develop and offer two additional variants will merely add somewhat to the complexity.

Limiting the types of silver plans that are available to an individual based on that individual’s income reduces consumer choice without furthering the overarching goals of the law. The strongest argument for implementing the requirement may simply be that it is a requirement of the law and doing otherwise would require a change in the law.

Varying the Scope of Covered Benefits

Context: Starting in 2014, all plans sold in the nongroup and small-group markets will be required to cover essential health benefits (EHBs), which include a range of services from preventive care to hospitalization.24 The law also requires that the “scope of the essential health benefits…is equal to the scope of benefits provided under a typical employer plan,”25 as determined by HHS. The scope of benefits means the types of services covered, numerical limits on covered services and exclusions. For example, a plan’s scope of benefits might include physical therapy but limit the number of visits to 10 annually, or a plan’s scope of benefits might include coverage to diagnose infertility but exclude coverage of infertility treatments or artificial reproductive procedures.

HHS has not yet issued a regulation defining EHBs. While there is a wide range of policy questions related to what benefits are included in essential health benefits, most of those questions are beyond the scope of this analysis. For the purposes of this policy analysis, the relevant question relating to EHBs is whether insurers have some latitude within the definition of EHBs to choose a wider or narrower scope of benefits. If insurers can vary the scope of benefits, the next issue is whether and how differences across plans in the scope of benefits should be reflected in the calculation of actuarial value.

Options. It is unlikely that HHS will define EHBs in a way that is so specific that it precludes any variation in scope of benefits. It is more likely that HHS will allow states and insurers some variation in the allowable scope of benefits—this approach would follow the Medicaid model in which the federal government established basic rules for benefit packages and states and insurers fill in the details. Assuming that some variation in the scope of benefits is allowed, the question then is whether that variation should be reflected in the calculation of actuarial value. One option is to define actuarial value in such a way that it does not depend on the scope of benefits. The other option is to define actuarial value so that expansions in the scope of benefits would increase actuarial value.26 HHS could leave these options open to the states.

To illustrate, one of the 10 categories that must be included in EHBs is “rehabilitative and habilitative services and devices.” Suppose HHS defined essential health benefits as requiring that all plans cover at least 10 physical therapy sessions per year. Under the first option, if a plan covers more than 10 physical therapy visits annually, there would be no change in actuarial value. Under the second option, if a plan covers physical therapy above the 10-visit minimum, it would be assigned a correspondingly higher actuarial value.

Trade-offs. The question of how to define essential health benefits and actuarial value may appear arcane but has important implications for plan design in the exchanges and for how consumers compare plans. Assuming HHS allows some variation in the scope of benefits within the definition of EHBs, the relevant question is whether actuarial value should depend on the scope of benefits. If actuarial value does vary with the scope of benefits, this would have two positive effects. The first is that the assignment of a plan to an actuarial value tier would summarize the generosity of the plan in a way that is intuitive to consumers—it would reflect both cost sharing and the scope of benefits. The second is that low-actuarial value plans—in the bronze and silver tiers—could be created through limitations in the scope of benefits without necessarily imposing high plan deductibles or other forms of cost sharing.

From a federal budgetary perspective, defining actuarial value so that it varies with the scope of benefits would likely result in larger outlays for exchange subsidies because the benchmark plan—the second-lowest-premium silver plan—used to calculate subsidies would be more generous.

Moving Managed Competition into Practice

Historically, state regulation of the nongroup health insurance market has balanced the protection of sicker individuals against the risk of regulating the nongroup market out of existence. In that context, insurers have, with some justification, opposed restrictions on how they define benefit packages, how they set premiums, and how they choose whom to offer coverage.

Several key provisions of PPACA will make the nongroup market much more stable than it is now. Starting in 2014, unless people have an employer offer of coverage or are eligible for Medicaid or Medicare or some other acceptable coverage, they will be required under the individual mandate to purchase nongroup coverage or face substantial penalties. And, the only way for individuals to get the new subsidies for nongroup coverage is by buying a plan through an exchange. The subsidies provide a substantial bolster to the exchanges; according to the Congressional Budget Office, they will total about $60 billion in 2016, or about $3,000 per exchange enrollee.27 Insurers also will have the “three Rs” to protect them against the downside risks of enrolling sicker individuals—risk adjustment, reinsurance and risk corridors.

PPACA essentially is designed to bring buyers and sellers to the table and to create a nongroup market that is robust enough that it can withstand tighter regulation. The law significantly raises the floor in terms of the minimum level of regulation of the nongroup market, for example, through guaranteed issue, modified community rating and no pre-existing condition exclusions. But, in keeping with the concept of managed competition, states may choose to go above and beyond the law’s minimums.

At this stage, policy makers largely are concerned with ensuring merely that federal requirements are met, that exchanges are formed, and that at least some insurers and consumers participate. But, over the long run, concerns likely will refocus on how best to foster healthy competition among insurers in the exchanges. Traditionally, the easiest way for nongroup insurers to make money has been to selectively enroll the healthy and selectively disenroll the sick. The intent of PPACA is clearly to close off that easy route and encourage competition based on the more challenging but more socially beneficial task of providing better health outcomes at a lower total cost.

Regulation of the exchanges also will likely turn out to have important fiscal consequences for the federal government. From the federal fiscal perspective, robust enrollment in the exchanges is a double-edged sword—it is crucial to the overall success of health reform, but it will also result in the federal government facing larger outlays for exchange subsidies.

Notes

1. Patient Protection and Affordable Care Act (PPACA) of 2010, Public Law No. 111-148, as amended by the Health Care and Education Reconciliation Act of 2010, Public Law No. 111-152, encompass the provisions of national health reform.

2. Enthoven, Alain C., “The History and Principles of Managed Competition,” Health Affairs, Vol. 12, No. 1 (January 1993).

3. PPACA limits the age-based premium variation in the nongroup and small-group markets to no more than 3-to-1, which could result in younger enrollees paying premiums that are high relative to their medical costs, and older enrollees paying premiums that are low relative to their medical costs. In that case, insurers would have a financial incentive to enroll younger individuals and to avoid older individuals.

4. The catastrophic plan will only be available to individuals who are under age 30 or who are exempt from the mandate penalty because an affordable plan is unavailable. It is not defined by a specific actuarial value. Instead, it is required to have a deductible equal to its maximum out-of-pocket, and both are set equal to the cap on the maximum out-of-pocket specified in the health savings account (HSA) rules ($5,950 in 2011 for single coverage).

5. PPACA, Sec. 1311(c)(1)(A).

6. Kaiser Family Foundation, What the Actuarial Values in the Affordable Care Act Mean, Washington, D.C. (April 2011).

7. Heiss, Florian, Daniel McFadden and Joachim Winter, “Who Failed To Enroll In Medicare Part D, And Why? Early Results,” Health Affairs, Web exclusive (Aug. 1, 2006).

8. Gruber, Jonathan, Choosing a Medicare Part D Plan: Are Medicare Beneficiaries Choosing Low-Cost Plans? Kaiser Family Foundation, Washington, D.C. (March 2009).

9. Polinski, Jennifer M., et al., “Medicare Beneficiaries’ Knowledge of and Choices Regarding Part D, 2005 to the Present,” Journal of the American Geriatrics Society, Vol. 58, No. 5 (May 2010).

11. Levy, Helen, and David R. Weir, “Take-up of Medicare Part D: Results from the Health and Retirement Study,” Journal of Gerontology: Social Sciences, Vol. 65B, No. 4 (October 2009).

13. Starc, Amanda, Insurer Pricing and Consumer Welfare: Evidence from Medigap, unpublished manuscript, Harvard University (2010).

14. American Academy of Actuaries, Critical Issues in Health Reform: Actuarial Equivalence, Washington, D.C. (May 2009).

15. Weil, Alan, State Policymakers’ Priorities for Successful Implementation of Health Reform, National Academy for State Health Policy, Washington, D.C. (May 2010).

16. The standard population’s medical claims are projected by taking historical claims for some population and applying an inflation factor. The choice of inflation factor is just one of the many consequential elements in defining the standard population.

17. PPACA, Sec. 1302(d)(2)(A).

18. American Academy of Actuaries, Actuarial Value under the Affordable Care Act, Washington, D.C. (July 2011).

20. Galbraith, Alison A., et al., Selection into Gold, Silver, and Bronze Health Insurance Exchange Plans: Lessons from Massachusetts, AcademyHealth Annual Research Meeting Poster Session, Seattle (June 2011).

21. Hall, Mark A., Risk Adjustment Under the Affordable Care Act: A Guide for Federal and State Regulators, Commonwealth Fund, New York, N.Y. (May 10, 2011).

23. The gold plan is more or less guaranteed to be offered in the exchange because of a provision in PPACA that requires any insurer offering a qualified health plan in the exchange to offer at least a silver plan and a gold plan. See Sec. 1301(a)(1)(C)(ii). But, in the absence of any regulation of relative premiums, the premium for the gold plan could end up being high enough that it would have little or no enrollment.