Among the most expensive “but nearly invisible” federal expenditures is the roughly $250 billion1 annual tax break for employer-sponsored health insurance. Under current law, the value of both employer and most employee contributions for health insurance are excluded from employee federal income tax and employer and employee payroll taxes. While most economists agree that the tax exclusion distorts marketplace behavior and encourages overly generous health coverage that leads to higher costs, typically both large employers and labor unions oppose eliminating or capping the tax exclusion for employer-sponsored health benefits. During debate of the 2010 Affordable Care Act (ACA), efforts to raise revenue and contain costs ultimately resulted in a 40-percent excise tax—the so-called Cadillac tax—on premiums of health benefit plans that exceed $10,200 for individuals and $27,500 for families starting in 2018. Since enactment, there has been interest in alternative approaches to the tax treatment of employee health benefits, with the issue gaining more attention recently as efforts to repeal the Cadillac tax accelerate. A new National Institute for Health Care Reform analysis compares the Cadillac tax to capping the tax exclusion on employer health benefits. The analysis found only modest differences in progressivity—or the degree to which higher-income people bear a higher tax urden—between the Cadillac tax and capping the tax exclusion, primarily because employers are likely to avoid a substantial portion of the taxes by restructuring health benefits, particularly in response to the Cadillac tax.

An Accident of History

The distinctive American tie between work and health insurance dates to World War II, when wage controls prompted many employers to offer tax-free health benefits to recruit and retain workers in lieu of increased wages. Now, deeply entrenched in the American way of doing business, employer-sponsored health insurance covered almost three of five Americans younger than 65 in 2013, although the share of people with job-based coverage has declined over time.

For decades, economists across the political spectrum have questioned the preferential tax treatment of employer-sponsored health benefits and recommended limiting the exclusion of the value of employer-paid health benefits from workers’ taxable income. They have argued that the tax exclusion—for both employer and employee contributions to health benefits—has encouraged overly comprehensive coverage, especially for higher-wage workers who typically benefit more because of their richer health benefits and their higher income tax rates.

And, overly comprehensive coverage likely has market-level effects as well, such as leading to higher provider prices and less cost-conscious practice styles, contributing to high and rising U.S. health care spending. But employers and unions, which traditionally have bargained for particularly rich benefits, oppose limiting the tax exclusion for health benefits on the grounds that emphasizing increased patient cost sharing, the easiest way to reduce insurance premiums, is not the most effective way to address cost trends and will harm many consumers. Providers also typically oppose changing the tax treatment of employer health benefits, contending that highly comprehensive coverage leads to better care. But the estimated federal revenue loss from this policy over the next 10 years is likely to be close to $3 trillion.

Health Reform and the Cadillac Tax

The need for revenue to fund the ACA, along with growing awareness that a change in tax treatment of employer health benefits might be a powerful cost-containment tool, led to serious consideration of reform. What emerged and was included in the ACA was a different—though broadly consistent—approach to the issue.

Rather than limiting what could be excluded from an employee’s taxable income for health insurance, the ACA included an excise tax of 40 percent on the portion of insurance premiums exceeding $10,200 for single coverage and $27,500 for family coverage in 2018, with the thresholds increasing over time at a rate lower than the projected rate of premium increases. While the optics of the Cadillac tax are quite distinct from limiting the tax exclusion of employer contributions—insurers or self-insured employers are being taxed rather than employees—most economists see broad similarities. And, economists would predict that employers will restructure their health benefits to lower the premium to avoid at least a portion of the tax and that most of whatever excise taxes are paid by insurers or employers will ultimately be shifted to workers through reduced wages.

But to the extent that taxes are paid—rather than premiums reduced to the threshold for taxation—the distributional implications of the Cadillac-tax approach could be important. The alternate approach—capping the exclusion from income taxes—has a distinctly progressive element. Higher-income people bear a higher tax burden because lower-income employees have lower marginal federal income tax rates. So if a premium exceeds the cap, lower-income employees will pay less in additional tax than higher-income employees. But to the degree that an insurer or employer is paying a 40-percent excise tax and decides to shift that cost to employees through lower wages, this could impact lower-wage employees disproportionately. Within any company, the costs of health insurance provided to lower-wage employees—and thus the amount of excise tax due—would be larger in relation to their wages.

This Research Brief examines the distributional implications of alternate approaches to taxing high-cost employer-based health insurance. Focusing on 2020, the analysis calculates thresholds for a tax-exclusion cap that would raise the same revenue as the ACA Cadillac tax provision. The tax exclusion cap analyzed here would apply only to income taxes and not to payroll taxes. Recent proposals have tended to limit the cap to income taxes—see, for example, a recent Bipartisan Policy Center proposal2—perhaps because capping the exclusion from payroll taxes would make the proposal substantially less progressive.3 For this analysis, standardizing the revenue gain is important because if one of the policy alternatives raised more revenue than the other, the effects of the differences in revenue could well swamp the differences in how the burden is distributed to different types of individuals.

Modeling Employer Reactions

The distributional impact of these alternate policies is analyzed through the RAND COMPARE model, which simulates the health insurance enrollment decisions of individuals and the health insurance offering behavior of firms under various tax and subsidy scenarios (see Data Source).4 The following steps were followed:

- Simulate employer health insurance offering behavior and premiums in 2020 under a “no-tax” scenario.

- Simulate the premium thresholds—or attachment points—that would trigger the tax and then simulate revenues raised under the Cadillac tax.

- Calculate attachment points for a hypothetical tax-cap policy that raises the same revenue in 2020 as the Cadillac tax.

- Compare workers’ health benefits and take-home pay under the no-tax, Cadillac-tax and tax-cap scenarios. The economics literature supports the notion that higher or lower employer spending on health benefits is shifted to employees through lower or higher wages, but this is a long-run relationship. In the short run, the shifting could be far less than 100 percent—for example, companies hiring from soft labor markets might offset little of the reduction in benefits with wage increases.5

Results

In general, the tax-cap approach is more progressive—takes a larger share of income from higher-wage workers than lower-wage workers—than the Cadillac tax. But the magnitude of difference in progressivity is far less than some might expect. The main reason for this result is that under the model’s assumption for both the tax cap and the Cadillac tax, most employers would take steps to reduce health benefit premiums to avoid paying additional taxes than leave benefits unchanged and pay the tax.

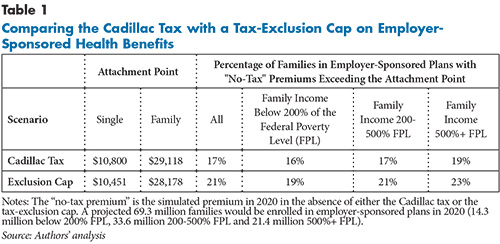

The simulated tax-cap alternative generated the same amount of federal revenue as the Cadillac tax but has an attachment point in 2020 of $28,178 for family coverage that is somewhat lower than what the ACA sets for the Cadillac tax—$29,118 (see Table 1). This is because employees’ marginal federal tax rates are less than the 40-percent Cadillac tax rate. So more families would be impacted by the tax cap—21.4 percent vs. 17.3 percent—but with smaller impacts per family. For both approaches, higher-income families are more likely to be affected than lower-income families.

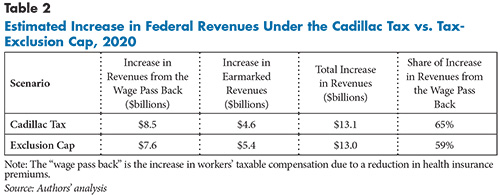

Revenue gains come from two sources—payment of excise taxes or income taxes for premiums in excess of the attachment points and income taxes generated from wage increases to compensate employees for health benefit reductions when employers restructure benefits to reduce premiums. Well over half of the increase in federal revenues comes from taxes on wage increases (see Table 2), diminishing differences in progressivity between the two approaches. Only 35 percent of Cadillac tax revenues comes from the excise tax; the rest comes from taxes on increases in wages to offset reductions in employer spending for health benefits.

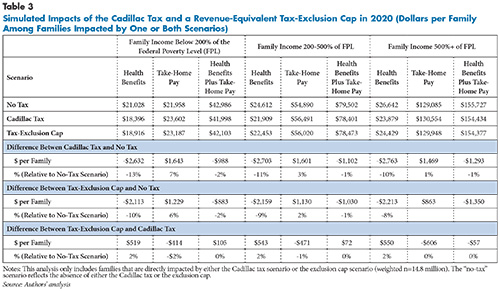

Impacts on families affected by these policy scenarios are examined through changes in what employers spend on health benefits and changes in worker take-home pay—wages less federal income taxes. For each income category, spending for health benefits declines (see Table 3), but the declines are notably larger for the Cadillac tax than for the tax cap. The declines from the Cadillac tax are very similar for different income ranges. Lower-income families tend to have somewhat larger dollar and percentage gains in take-home pay than higher-income families under the Cadillac tax, with this likely coming from their lower marginal federal tax rates applied to wage increases and that the wage increases are larger in relation to the base. The gains in take-home pay under the tax cap vary more by family income, which is the source of the greater progressivity.

But when changes in health benefits are combined with changes in take-home pay, the differences in progressivity between the Cadillac tax and the tax cap are modest. Impacted families below 200 percent of poverty lose $105 less per year under the tax cap than under the Cadillac tax. Impacted families with incomes between 200 percent and 500 percent of poverty lose $72 less under the tax cap, while those with incomes in excess of 500 percent of poverty lose $57 more under the tax cap. While differences in progressivity are in the expected direction, they are quite small.

Polar Employer Responses

To better understand the results, further simulations were conducted that varied the assumptions about employer responses to the policies. Two polar assumptions were used. Under one, employers were assumed not to make changes in their health insurance offerings in response to either policy—the benefits—and thus premiums—would remain the same. This means that for health plans with premiums above the attachment point, the employers would pay the Cadillac tax and shift the amount of tax paid to employees through lower wage rates.

In the case of the tax cap, the employees would pay the taxes due on the portion of the premium above the threshold.6 Under this scenario, the tax cap is significantly more progressive relative to the Cadillac tax.7 Lower-income families gain under the tax cap compared to the Cadillac tax (losing $236 less), while middle-income families gain slightly (losing $119 less). But higher-income families lose $270 more under the tax cap than under the Cadillac tax.

The other polar assumption is that all affected employers alter benefits enough to reduce premiums below the thresholds for the Cadillac tax or the tax cap. Since employers would be spending less on health coverage, the model assumes the savings would go to employees as wage increases, which would be taxed as income. This assumption appears much closer to reality than the other polar assumption. There has been extensive discussion in the media about how employers already are scaling back health benefits to begin a multi-year process of reducing premiums so that by 2018 they do not exceed the Cadillac tax threshold.8 One reason for this is that Section 49801(f)(10) of the ACA prescribes that the excise tax is not a deductible business expense for federal tax purposes. So for-profit insurers would have to raise premiums by a multiple of the excise tax to avoid losing money and self-insured employers would have to shift a multiple of the tax to wages. This impacts health benefits very unevenly since it would not apply to nonprofit insurers or to public or nonprofit employers. But for those affected, it would make reducing benefits to avoid paying the tax highly compelling.

Under the assumption that health benefits are changed enough to remain under the thresholds, the impact of the Cadillac tax and tax cap would be quite similar across income groups.9 Lower-income families gain under the tax cap compared to the Cadillac tax (losing $160 less), while middle-income families gain slightly more (losing $176 less). Higher-income families gain slightly less (losing $119 less under the tax cap than the Cadillac tax).

Implications

In this instance, the progressivity of contrasting approaches to taxing insurance with particularly high premiums depends a great deal on how employers respond to the policy. While an excise-tax approach (Cadillac tax) has the potential to be less progressive than one removing or limiting the exclusion of the value of health benefits from income taxes, the likely employer responses substantially reduce the differences.

Indeed, how employers respond is also relevant to the degree to which revenue is raised and health insurance benefits change. If employers just pay the excise tax and don’t restructure health benefits to lower premiums, the Cadillac tax will not impact the nature of employment-based health insurance and achieve the cost containment that most economists believe will result from less comprehensive coverage. But employers appear to be responding vigorously, suggesting that impacts on health care and consumers will be substantial. The very strong incentive under the Cadillac tax for for-profit insurers and employers to address all of the excess premium by changing health benefits rather than paying the tax is likely not ideal, especially considering the geographic variation in premium costs. In contrast, the tax cap likely would yield a mix of tax payments and benefit changes. Congress also could diminish the strong incentive to change benefits under the Cadillac tax by making the excise tax payments deductible.

Progressivity is not the only fairness issue involved in these policies. While the attachment points for the Cadillac tax are intended to affect only health benefits that are particularly generous, other factors, such as the age and gender mix of company workforces and premium variations for comparable coverage in different geographic areas, can lead to high-cost coverage. The ACA allows for adjustments for some differences in workforces, creating higher thresholds for certain “high-risk professions” and authorizing the IRS to make adjustments for workforces with age and gender mixes differing from the national average. The agency is now working on how to make such adjustments. Actuaries have good tools to do this, although regular reporting of such data by employers could be cumbersome. But it does not address the geographic variation in premiums for comparable plans, which, according to a recent analysis is a larger issue.10

Geographic adjustments could be pursued through creation of a geographic index of costs of insured health benefits and adjustments of attachment points by this index. But Congress has historically resisted such geographic adjustment in the tax code. An alternative that would deal with both the geographic and demographic variation issues would convert the Cadillac tax or tax cap to address “excessive” actuarial value rather than premiums. People are now more familiar with the use of actuarial value—or the average share of covered medical services paid for by a plan—to define the bronze, silver, gold and platinum benefit tiers in the health insurance marketplaces. And, the state of the art in making accurate calculations of actuarial value is likely advancing. The main limitation of using actuarial value is that it provides just one aspect of health plan characteristics that are relevant to costs and could undermine the role of other cost-containment tools such as breadth of provider networks and degree of utilization management.

Notes

1. Congressional Budget Office, Options for Reducing the Deficit: 2014 to 2023, Washington, D.C. (November 2013). Accessed at www.cbo.gov/sites/default/files/cbofiles/attachments/44715-OptionsForReducingDeficit-3.pdf

2. Bipartisan Policy Center, A Bipartisan Rx for Patient-Centered Care and System-Wide Cost Containment, Washington, D.C. (April 2013). Accessed at http://bipartisanpolicy.org/wp-content/uploads/sites/default/files/BPC%20Cost%20Containment%20Report.pdf

3. Payroll tax rates are not graduated and do not apply to the portion of earnings that exceed $118,500 in 2015.

4. For methodology details, see White, Chapin, Sarah Nowak and Christine Eibner, Can the Cadillac Tax Be Made Less Regressive by Replacing It with an Exclusion Cap? Methods and Results, RAND Corporation, Santa Monica, Calif. (Oct. 8, 2015). http://www.rand.org/pubs/research_reports/RR1321.html

5. Ginsburg, Paul, Alternative Health Spending Scenarios: Implications for Employers and Working Households, Health Policy Issue Brief, Brookings Engelberg Center for Health Reform, Washington, D.C. (April 2014). Accessed at http://www.brookings.edu/~/media/events/2014/04/11-health-care-spending/alternative_health_spending_scenarios_ginsburg.pdf

6 For this scenario, the attachment point for the tax cap had to be lowered to maintain revenue neutrality, so more families would be affected.

7. See Table 4 in White, Chapin, Sarah Nowak and Christine Eibner, Can the Cadillac Tax Be Made Less Regressive by Replacing It with an Exclusion Cap? Methods and Results, RAND Corporation, Santa Monica, Calif. (Oct. 8, 2015).

8. See, for example, Abelson, Reed, “Health Care Tax Faces United Opposition From Labor and Employers,” The New York Times (July 21, 2015). Accessed at http://www.nytimes.com/2015/07/22/business/labor-and-employers-join-in-opposition-to-a-health-care-tax.html

9. See Table 5 in White, Chapin, Sarah Nowak and Christine Eibner, Can the Cadillac Tax Be Made Less Regressive by Replacing It with an Exclusion Cap? Methods and Results, RAND Corporation, Santa Monica, Calif. (Oct. 8, 2015).

10. Dobson, Robert H., and Stuart D. Rachlin, What Does the ACA Excise Tax on High-Cost Plans Actually Tax? Milliman Client Report, Tampa, Fla. (Dec. 9, 2014).