As consensus grows that true reform of the U.S. health care system requires a move away from fee-for-service payments, designing alternative payment methods, including episode-based payments, has emerged as a high priority for policy makers. An episode-based payment approach would essentially bundle payment for some or all services delivered to a patient for an episode of care for a specific condition over a defined period. Ideally, a well-designed episode-based payment system would encourage providers to improve efficiency and quality of care. Careful consideration of how to design and implement episode-based payments, however, will set the stage for their success or failure. Key policy considerations include how to define episodes of care; establish episode-based payment rates; identify which providers should receive episode-based payments; ensure compatibility with other proposed payment reforms; and stage implementation to focus on a set of priority conditions, patients and providers.

Bridging the Gap Between Fee-for-Service and Capitated Payments

Although the broader health care reform debate has sidestepped in-depth discussion of provider payment reform, a consensus has emerged among health policy experts that fee-for-service payments contribute to:

- the overuse of well-reimbursed services and the underuse of less lucrative services;1

- a medical culture that places little value on such activities as care coordination that are not explicitly reimbursed;2 and

- a fragmented delivery system that patients and providers find increasingly difficult to navigate.3

Even if policy makers correct distortions in how different services are priced, fee-for-service payment still tends to reward volume of care rather than quality or efficiency.4

At the other end of the spectrum, capitated payments—fixed per-enrollee, per-month payments—provide strong incentives for care coordination to maximize efficiency and could motivate higher quality if accompanied by quality-based bonuses. However, full capitation, where the provider is at risk for all care required by a group of patients, exposes providers to financial risk that few are capable of managing well given current market and practice structures. Moreover, while fee-for-service payment raises concerns about incentives for providers to deliver unnecessary care, full capitation raises the opposite concern—that providers might withhold needed services to maximize profits.

In today’s fragmented delivery system and payment environment, individual providers have little financial incentive to step out of their silos to coordinate care across a patient’s conditions and care settings and limited ability to influence the behavior of other providers. The quandary for policy makers is how to motivate providers to reconfigure their practice arrangements and care processes to produce more efficient and coordinated care without setting many of them up for failure with a rapid transition to full capitation. Between the two extremes of fee for service and capitation lie intermediate models that pay providers based on a set of related services delivered to a given patient.5

For example, bundling payment for hospital readmissions into the inpatient diagnosis-related group (DRG) payment would encourage hospitals to reduce infections and improve care transitions for patients from the hospital to the community. A more ambitious intermediate model would be accountable care organizations (ACOs), where fee-for-service payment is augmented by bonuses or penalties based on the efficiency and quality of care for all services a patient population attributed to the ACO receives during a predetermined period.

This analysis addresses another intermediate approach—episode-based payment—that would bundle payment for some or all services delivered to a patient for an episode of care for a specific condition over a defined period. For example, the care received by an auto-accident victim from triage in the emergency department through hospitalization, trauma surgery and rehabilitation could comprise an episode. In theory, episode-based payments provide financial incentives for providers to improve efficiency and coordination of care.

The Medicare program has experimented with some forms of bundled payment. In the 1990s, Medicare conducted a demonstration to bundle physician and hospital payment for coronary artery bypass graft surgery (CABG). The demonstration produced cost reductions of between 12 percent and 27 percent across the participating hospitals.6 Despite this early success, Medicare did not broaden bundled payments to other major inpatient episodes until the 2009 Acute Care Episode (ACE) demonstration, which bundles payment for hospital and physician services for a select set of inpatient episodes of care for orthopedic and cardiovascular procedures.

As with all significant payment reforms, paying on the basis of episodes requires many design decisions, some of which have received more research and policy focus than others.7 Indeed, the effectiveness of the strategy will depend in large part on the wisdom reflected in these decisions. This analysis addresses the following design issues related to developing episode-based payments:

- defining episodes of care;

- establishing episode-based payment rates;

- identifying providers to receive episode-based payments;

- compatibility with other proposed payment reforms; and

- staging implementation.

There are different ways to define an episode of care, and any given approach has more potential pitfalls for certain types of care episodes than others. Once the episodes are defined and those most suitable for bundled payment are selected, payment rates must be established. To thread the needle by setting payments in a way that is both fiscally sustainable and motivates providers to behave in desirable ways is a particularly thorny issue, technically and politically.

Another design issue is deciding which providers should be paid on the basis of an episode. This involves decisions regarding which providers to attribute an episode to and whether to spread the incentives broadly across the providers or to concentrate the incentives on a smaller number of providers.

There are also a wide range of other proposed payment reforms, and a question inevitably arises about which ones are mutually exclusive and which are complementary and can be pursued simultaneously with episode-based payments. The final issue is implementation strategies, including staging implementation to focus first on a narrow set of priority conditions, patients and providers, and addressing potential legal barriers. Such an approach allows both providers and payers to gather data and experience and make adjustments for a broader, more ambitious later phase.

Defining Episodes of Care

At the most basic level, episodes of care have two major dimensions: 1) a clinical dimension, including what services or clinical conditions comprise the episode; and 2) a time dimension that reflects the beginning, middle and end of an episode. A typical episode might focus on a heart attack, beginning with the onset of a patient’s chest pain, continuing with urgent care by a physician or emergency services provider, followed by hospitalization services and any procedures performed, and lastly post-acute and rehabilitation services during a recovery stage.

An episode also might be defined as a major procedure, such as hip replacement, and include services delivered during the hospitalization as well as major post-acute services provided after hospital discharge. For chronic conditions, such as congestive heart failure, an episode could be defined as a period—a month or a year—of management of the condition, including physician services, the services of other personnel and, in some cases, hospital stays.

Using Data to Identify Episodes

Different approaches for defining episodes will require different types of data. For example, defining episodes retrospectively, after they have been completed, allows payers to use a variety of readily available data, such as claims. Defining episodes in real time as they occur may require more detailed clinical data and potentially patient input as well.

Episode groupers. Researchers and payers experimenting with episode-based payments typically identify episodes of care retrospectively using computer software packages, commonly referred to as episode groupers (see box below for more information on episode groupers). Episode groupers are designed to search data, such as medical claims or records of care encounters, to identify 1) whether or not patients have experienced particular types of episodes; 2) when the episode began and ended; and 3) the services received during the period that should be included in the episode.

Episodes for a given patient are defined in terms of the presence of one or more medical diagnoses, major procedures, and/or other major medical events, such as hospitalizations. Groupers also classify episodes based on other clinical conditions that the patient may have in addition to the main condition of interest. Episodes are then further characterized in terms of all relevant medical services associated with the particular diagnoses or major procedures during a defined period. For example, grouper software packages typically identify the beginning and end of episodes based on the presence of sufficiently long “clean” periods before and after the episode when no related services were provided. Grouper software packages also may provide options for attributing episodes to particular providers and allow for the estimation of per-episode costs.

Data needs. Efforts to define episodes in specific populations, such as the enrollees of a single health plan or patients in an integrated delivery system, require comprehensive data with accurate information on diagnoses, co-morbidities, types of services, dates of service, service costs, and patient and provider identifiers. Most medical claims or sources of encounter data contain the required types of information and can be used for specifying episodes. However, the amount of detail on both diagnoses and services is limited, because these systems were designed for use in fee-for-service payment rather than for defining episodes of care. Limitations in current procedure and diagnosis coding standards also are factors. In the future, electronic medical records or registries with more comprehensive and verifiable clinical information may permit more sophisticated methods to construct episodes in either real time as they occur or after the fact as current episode groupers do.

Episode Groupers

The most widely used commercial episode groupers are Episode Treatment Groups (ETGs) developed by Symmetry and Medstat Episode Groups (MEGs) developed by Thomson Reuters.8 Commercial health plans and other payers use these applications, which also are being tested by Medicare to produce feedback reports for physicians on their resource use.9 For the most part, episode-grouper applications have not been used for payment purposes. The groupers’ underlying algorithms also are not well understood by policy makers and providers given their proprietary nature. The most common episode-grouper applications have focused on cost and quality monitoring, provider feedback, and tiering of providers based on their resource use patterns to establish high-performance networks.10

Public-domain groupers and those used specifically for payment are less well developed to date but may emerge as more transparent alternatives. For example, the Brookings Institution is leading a collaboration to develop public-use, claims-based definitions of episodes for a wide range of conditions for potential use in cost measurement, performance reporting and payment reform.11 Some individual payers or delivery systems also have developed home-grown approaches that do not rely on claims data for identifying episodes of care for cost monitoring and payment purposes. For example, Geisinger Health Plan’s ProvenCare system offers provider payment incentives for quality and efficiency of care delivered in selected episodes.12 Proposed health care reform legislation mandates that the Centers for Medicare and Medicaid Services (CMS ) support the development of a public-domain grouper by 2012, something the agency has already announced plans to explore. 13

Researchers also have developed episode-grouping methods for a limited number of conditions as part of the PROMETHEUS Payment model, which is using episode-based payments in several pilot sites.14 PROMETHEUS relies heavily on accepted clinical practice guidelines for care of a specific condition, such as a heart attack, and “builds up” the expected costs of recommended services. A substantial advantage is the clinical face validity that comes from defining “good care” and specifying the attendant services, but maintenance over time as standards of care change could require resource-intensive updates to the calculations.

Key Issues in Defining and Identifying Episodes

Policy makers will need to consider several key issues in selecting or developing a software tool to define episodes of care, link episodes to payment and select which episodes to include in a payment program.

Clinical features of episodes and feasibility of using available data. The selected episodes should have well-defined and well-understood clinical definitions, allowing both providers and payers to classify patients and group their associated services. For example, providers and payers should be able to tell which types of patients and services clearly fall into specific types of episodes. Episodes with clear beginning and end points would allow all participants to identify patients experiencing a measured episode and make it easier for payers to link payment to specific episodes.

Ideally, sound clinical logic should also underlie episode definitions. That is, when actual patterns of service delivery are closely associated with the severity and progression of a disease, then claims or encounter data can capture care for a specific condition—with the input of experienced clinicians—and payers can more confidently link financial incentives to those episodes with the expectation that providers could improve care for those episodes.

For example, acute-care episodes may be more practical to define than those for chronic conditions because of their clear beginning and end points and generally predictable course of disease, assuming that practice norms and clinical guidelines are followed. Episodes of chronic conditions are more challenging because of an unclear onset period and lack of end point, with often-unpredictable needs for service use following onset. Chronic conditions can involve episodes of varying severity, but these are often difficult to identify with existing diagnosis coding schemes and data.

Utilization and cost variation. Policy makers also need to consider the extent of variation in utilization and cost when selecting episodes for payment purposes. Ideally, episode-based payments can be linked to episodes where utilization and cost variation is the result of provider behavior and under providers’ control in the context of actual care relationships among providers. Episodes with highly unpredictable service patterns and/or disease progression that are largely outside of providers’ control may be unsuitable for episode-based payments. For example, although it is straightforward to define the start of a trauma episode, surgeons and emergency department physicians have little control over the severity of a trauma patient’s injuries, making even similar and easily specified trauma episodes—such as automobile accidents—difficult to compare in a meaningful way for payment purposes.

Another factor to consider when selecting episodes is whether there are well-established norms, clinical guidelines or best practices that can serve as goals for providers.

Provider attribution and accountability. Policy makers also must consider how easily or appropriately episodes can be attributed to providers for payment and accountability purposes. Some types of episodes may involve too much variation in the types of providers involved in treating different aspects of the underlying conditions. For example, it is more difficult to predict the relative involvement of primary care physicians, different subspecialists, hospitals and post-acute care facilities in an episode of heart attack than in an episode of cataract care. In the less predictable cases, it may be difficult to assign clear responsibility for the episode to a small enough number of providers to keep payment approaches simple and transparent.

Conversely, certain types of surgery-based episodes, such as orthopedic procedures, allow for clearer and more predictable assignment of care responsibilities, making them amenable to episode-based payment approaches. For instance, hip surgeries always involve a major procedure and hospital stay. The treating orthopedic surgeon and hospital could be assigned primary accountability for surgical outcomes and post-acute care, including avoidance of complications resulting in hospital readmissions or the need for subsequent procedures.

While payers may choose to engage patients in identifying their primary providers, episodes could be attributed without payers needing to interfere in patients’ existing care relationships. Therefore, Medicare could implement episode-based payments regardless of the geographic dispersion of a beneficiary’s providers, although local private payers might have to limit attribution to the markets where they have enrollees.

Visibility and relevance to clinical practice. From a provider’s vantage point, the method for selecting and specifying episodes would also take into account how understandable episodes are to providers. That is, providers should be able to recognize when an episode has begun and understand and reasonably predict the full range of services that a patient might need during the course of a typical episode of that type. These might include both services delivered by that provider and services from other providers. Such transparency and predictability would help ensure that providers can respond appropriately to episode-based payment incentives by enhancing care coordination.

Establishing Payment Rates in Episode-Based Systems

Defining the unit of payment, determining how to make payments to providers in actual program operations, establishing base payment rates, and adjusting payments for the patient’s level of illness and the provider’s quality and efficiency performance are all important considerations. The details of how payments are structured have important implications for the operational burden on payers, the face validity of the episode-based payment program with providers and how equitable payments are across different providers.

In concept, the unit of payment in an episode-based payment program is an entire episode of care—in much the same way that individual medical services are the units of payment under fee-for-service systems. Under episode-based payment programs, payment would be tied to individual episodes, just as fee-for-service payments are tied to individual services. Payment would then be calculated over a particular accounting period, such as a year, and directed to a particular provider, such as a hospital or medical practice.

In practice, episode-based payment approaches may target only a certain subset of services within an episode. For example, payers could focus on physician services or diagnostic imaging services delivered during particular phases of the episode, such as during a hospital stay, or selected providers involved with the episode, such as only cardiologists involved in a heart-attack episode.

Spectrum Between Fee for Service and Capitation

How payments are designed will depend in large part on providers’ willingness and ability to assume financial risk and accountability for quality performance for episodes of care, as well as payers’ willingness to delegate risk and accountability. An initial step might be minor modifications to existing fee-for-service payments, with providers receiving payment of withholds or bonuses if they perform well on measures of quality and efficiency that reflect care within an episode. One advantage of this approach is that providers need not face substantial financial risk—depending on the size of withholds or bonuses—that many might be unable to manage well. Another advantage is the relative operational ease for payers because they could implement this method with existing data, and decisions about which provider should receive a bundled payment would be unnecessary. Of course, the main disadvantage is that less financial risk is likely to result in only modest provider behavior changes.

Alternatively, payers could put providers directly at financial risk for the cost of all or some portion of the services delivered within episodes through prospectively determined payments for bundles of services. For payers, this approach would likely require new or improved data on the typical or target costs of each episode. If a program focuses on only a small number of episode types, payers could negotiate the relevant payment amounts, as Medicare does in the ACE demonstration. For providers, it would require careful management of services delivered during the episode and plans for coordination with other providers.

Hybrid approaches also are possible, such as payers putting providers at partial risk for services within an episode. For example, payers could offer prospectively determined payments but establish risk corridors that set an amount above which providers would not be financially liable. Some providers also could share risk for certain services within episodes while being paid fee for service for other care. For example, all ambulatory physician, laboratory, pharmacy and imaging services delivered during an episode might be paid with a single bundled payment, but costs of hospital stays and post-acute care might be paid separately with fee for service or other payment structures, such as DRGs.

As these examples illustrate, payment designs in episode-based payment programs will likely fall somewhere along a continuum from largely fee-for-service payments with limited bundling of services to full bundling of all services within the episode. These decisions will depend in large part on ease of implementation and on the desired trade-offs between providers’ ability and willingness to accept financial risk and the incentives for changes in care delivery.

Establishing Base Payment Rates for Episodes

Regardless of the particular payment methods used, payers will need to set the level of base payment rates that are tied to the appropriate unit of payment—the episode or certain services within the episode. These rates could serve as benchmarks to compare a given provider’s efficiency performance in a modified fee-for-service scheme at one end of the payment spectrum. Alternatively, base rates could serve as a basis for prospective bundled-payment rates closer to the capitation end of the payment spectrum.

There are several ways that payers could calculate and update base payment rates for episodes of care. In general, payers would establish a different base payment rate for each particular episode type—pneumonia vs. hip fracture, for example—reflecting the varying costs incurred by providers in treating these conditions.

Payment rates based on historical costs. Payers could opt to use historical data on service use and costs per service for particular conditions. For example, commercial episode groupers calculate efficiency scores based on comparisons of a provider’s actual per-episode costs with expected costs based on costs for the median provider—the provider whose performance is in the middle of the cost spectrum across peers, representing the 50th percentile. Alternatively, the base rate might be set at lower or higher points along the prevailing cost distribution. Selecting a higher benchmark or base rate, such as the 75th percentile, would encourage more providers to participate—a potentially important advantage in the early phase of a voluntary episode-based payment program. In contrast, payers might opt for a lower benchmark or base rate, such as the 25th percentile, if they believe there is significant room for improved efficiency.

The main advantage of using historical costs is operational ease and the potential for payers to address a broad range of episode types. The main disadvantage is that relative benchmarks do not reflect the ideal patient care for a given episode and, therefore, lack clinical face validity with providers.

Payment rates based on external cost benchmarks. A related decision is whether to use internal or external cost benchmarks to establish payment rates. Payments based on internal data—for example, data covering the patients enrolled in a given episode-based payment program with a specific payer and the participating providers in that program—have the advantage of reflecting the particular health care needs of the population and local medical standards. Payments based on external data—such as data from a population that includes patients not enrolled with that payer or its episode-based payment program—avoid grading providers on the curve by holding them to higher standards. Other advantages of this approach include providing the same fixed standard rather than comparing providers to one another, thereby minimizing the chances that payments would fall to ever-lower levels over time as the average efficiency performance of participating providers improve.

Payment rates based on guideline-based standards. Another approach, similar in some respects to external cost benchmarks, is to establish payment rates in a bottom-up fashion, based on identifying what a particular type of episode, such as a hip fracture, would cost if providers strictly delivered only recommended care. These normative approaches largely ignore actual or typical patterns of service utilization and instead focus on establishing payment rates based on the costs associated with best practices or well-accepted clinical guidelines. Depending on the circumstances, these rates might be higher or lower than empirically based rates. The PROMETHEUS Payment model is one well-developed example, where “evidence-informed case rates” are set based on the resources required to provide recommended care outlined in well-accepted clinical guidelines.15 The main advantage of this approach is that it sets a high and clinically valid standard for efficiency performance, which would maximize face validity from providers’ perspectives and reassure patients that efficiency improvements would not jeopardize their receiving appropriate care.

But normative payment rates pose several substantial challenges for payers. First, clinical guidelines do not exist for all types of episodes, although guidelines are available for some of the most prevalent and costly episodes, such as ischemic heart disease and diabetes. And, where they do exist, guidelines may not address the full range of services provided within a type of episode.

Second, guidelines change over time as scientific evidence grows, and regularly updating guideline-based payment rates could be a costly and time-consuming endeavor. Third, clinical guidelines are often based on scientific trials that enroll relatively homogeneous patients (for example, they often do not include elderly patients), and guidelines sometimes do not address in sufficient detail the appropriateness of therapy for patients with multiple conditions.16 As a result, normative payment rates based on such guidelines may not be clinically appropriate for the particular patient populations enrolled with a given payer. Fourth, should guideline-based payment rates fall substantially below historical rates, physicians may not accept their validity. In that case, an alternative might be to combine approaches and reduce services in excess of guidelines by basing rates on historical experience and allowing incentives from bundled payment to induce physicians to change their practice.

Approaches for updating rates over time. Some payers, such as Medicare or large commercial insurers, might have the resources to develop sophisticated methods to assess the accuracy, equity and reasonableness of initially established rates. Over time, however, rates will need to be revised or updated based on cost trends, expert opinions or a combination of these. Given Medicare’s poor track record in implementing accurate updates, policy makers cannot assume that appropriate adjustments will occur without adequate resources and oversight.17

Case-Mix Adjustment of Rates

Once base rates are established for different types of episodes, payers will need to adjust rates to account for differences in patients’ disease severity—so called case-mix or risk adjustment. In some respects, episode groupers are a form of case-mix adjustment because they attempt to group patients who experience the same condition at similar levels of severity. This may reduce the difference in service needs and expected service use that is outside of the providers’ control. But because the algorithms in episode groupers only explain some of the variation in costs within an episode type, payers would likely need to perform additional case-mix adjustment.

Payers do not have much experience with case-mix adjustment of episode-based payment rates, and substantial, ongoing research is clearly needed to develop and test appropriate methods. Most current case-mix adjustment methods were developed to predict the clinical or cost outcomes for a patient across conditions and care settings and are usually based on at least one year’s worth of data for each patient and have not been tailored to care episodes. Moreover, methods of adjusting for potentially relevant non-clinical differences within and across episodes, such as a patient’s race/ethnicity or socioeconomic status, are still poorly developed.

Adjusting Payment Rates for Quality

Adjustment of payments for performance on quality measures is critical for any episode-based payment program that seeks to substantially improve the quality of care and hold providers accountable for outcomes under any incentives that might prompt providers to withhold needed care. Adjustments for quality performance could be applied to any basic payment arrangement, such as adjustments to fee-for-service payments or to bundled payments based on delivery of recommended services or attainment of desired clinical outcomes during the episode.

In practice—and depending on the breadth of available measures for particular conditions—quality measures could be based on a full range of services during the entire episode, or they might focus on only one aspect of care for patients experiencing particular episodes. For example, for certain cardiology-based episodes, payments could be adjusted on the basis of a fairly broad set of available measures, ranging from delivery of appropriate services for acute episodes (administering beta-blockers to heart attack patients) and avoidance of adverse outcomes (post-discharge mortality rates for cardiac procedures).18 For other types of episodes, such as a patient with atrial fibrillation—a type of heart arrhythmia—available quality measures may be more limited (initiation of anti-coagulation therapy to prevent strokes).

Actual experience with quality adjustment in episode-based payment programs is still limited. The PROMETHEUS Payment model bases payment rate calculations in part on quality performance measures. Geisinger’s ProvenCare payment system also addresses quality performance and has been shown to have promising effects on cost and quality.19 Yet, these efforts have been applied to limited populations for a limited set of episode types. Continued investment in quality-measure development covering the range of conditions that might be targeted for episode-based payment programs is critical to long-term success in improving quality.

Identifying Providers to Receive Episode-Based Payments

Iow a payer identifies providers responsible for a given episode of care has important implications for the feasibility and effectiveness of episode-based payments. Payers could target broad groups of providers with mandatory payment systems but only if they entail modest financial risk for the provider. Payers could simultaneously refine payment structures that impose greater financial risk and offer them to smaller subgroups of providers who are more capable of voluntarily assuming that risk. Identifying the responsible providers before an episode begins, and doing so on the basis of real care relationships rather than use of secondary data, such as claims data, may be resource intensive and politically fraught. But such an approach could also build a key foundation for providers and patients to come to a mutual understanding of care relationshipsand consciously focus on improving care coordination and efficiency.

One Provider, Two Providers, Three Providers, More…

The simplest approach to identifying providers responsible for an episode of care is to hold all providers delivering care within an episode jointly responsible for patient outcomes. That is, payers can continue to pay each provider fee for service but offer bonuses—or repayment of withholds—based on the relative efficiency of care for that episode and its measured quality. Taking this retrospective tack would be operationally straightforward for both providers and payers. Payers would not have to first calculate the average costs for a given type of episode to reimburse providers for their services. But payers could easily make such estimates of average costs after the episode ends and use such benchmarks to determine whether the provider should receive a bonus. This approach would clearly put providers at less financial risk than a system with a single payment that covers the entire episode.

The main disadvantage of retrospectively identifying providers is that responsibility for improving coordination and efficiency could be diffused among many providers that are not completely aware of who else is providing care to the patient and, thus, would likely result in only modest care-delivery improvements. For example, an orthopedic surgeon would certainly know what hospital her hip fracture patient is in, but a primary care physician might not be aware of which neurologist her low back-pain patient self-referred to. In the first example, if the payer supported the orthopedic surgeon with historical data on costs per episode, the surgeon could make more-informed choices about directing the patient to a particular hospital and rehabilitation facility. But in many cases, payers will not be able to determine which providers are responsible for a given episode until long after the relevant services have been delivered.

Alternatively, payers could allow groups of providers to voluntarily apply for recognition to have their services carved out of the fee-for-service payment structure for a given type of episode. In this case, the volunteer providers could accept sole responsibility for all such episodes that they treat and receive a prospectively paid bundled payment for delivering those services. In this manner, the process of identifying the responsible provider shifts from the retrospective approach to one that can happen either before or after the episode occurs. Payers could also choose to place volunteer providers at financial risk for the total costs of an episode, including services delivered by providers that are not in the volunteer group. Alternatively, payers could put the volunteer providers at risk for just the services they deliver and continue to pay outside providers fee for service but attribute the cost of those payments to the “performance” calculation for the volunteers.

Participants likely would do well under this approach, since those who start with lower costs and are more confident of their efficiency are more likely to volunteer. Payers could shift rewards toward these more efficient providers and offset the fiscal impact through withholds for the other providers, motivating providers to enter voluntary arrangements.

Data Sources for Attributing Episodes of Care

Payers also have to choose what data they will rely on for attributing episodes of care to providers. Payers could use a quantitative method that examines care patterns in claims data. For example, payers could attribute an episode to the provider that billed for the greatest number of encounters with that patient during the episode, potentially adding such nuances as selecting providers from a particular specialty, such as the most involved cardiologist in a heart-attack episode. An algorithm that could be used prospectively would designate the orthopedic surgeon as the responsible provider in hip fracture episodes.

Limiting attribution to claims data would be easier for payers to implement and lower the risk that providers would engage in favorable selection of less-costly patients but would offer less flexibility for payers to tailor attribution to specific clinical scenarios or to pay providers prospectively. Relying on claims data for attribution may also not reflect actual care relationships accurately, which might result in the episode-based payment program having less face validity with patients and providers. Alternatively, payers could gather additional data, such as providers identifying which patients they treat, or patients identifying which provider they perceive as the responsible provider. This approach may be particularly appropriate if attribution is done prospectively.

As payers offer episode-based payments for a growing number of episode types, providers may naturally coalesce to assume joint responsibility for related types of episodes. For example, if payers developed episode-based payments for different types of cardiac care episodes, such as cardiac arrhythmias, heart attacks and CABG surgeries, groups of cardiologists, cardiac surgeons, hospitals and general internists could collaborate in applying to receive bundled payments for those episodes. Once episode-based payments become available for a wide range of episodes, payers could consider converting to capitated payments for each accountable provider group to assume responsibility for all the care of a specified patient population.

Compatibility with Other Payment Reforms

Interest in provider payment reform has neared critical mass in recent years, with many approaches under consideration. Substantial revamping of Medicare’s physician fee schedule is already underway, with a far-reaching Centers for Medicare and Medicaid Services’ (CMS) final rule for the 2010 fee schedule that uses updated, consistent data on practice expense, leading to bolstered payments for primary care services. Either health reform legislation or Medicare legislation is likely to include more changes in how Medicare fee-for-service payments are set for different services.

Some congressional health reform proposals include penalties for hospitals with high rates of Medicare readmissions and require bundling payment for post-acute services with inpatient hospital care. Other proposals focus on patient-centered medical homes, which involve partial capitation payments for such currently unreimbursed services as care coordination and patient education, and accountable care organizations, which involve incentives for quality and efficiency when caring for a defined population of beneficiaries.20

Reforms to Fee-for-Service Payment

Reforms to Medicare fee-for-service payment would increase the likelihood of success for episode-based payments. Strong evidence exists that relative fee-for-service payment rates for different physician services, especially when an important part of the payment is for equipment and staff costs, do not align closely with relative costs. The result is that the Medicare physician fee schedule tends to reward technical specialty procedures handsomely and evaluation and management services and other so-called cognitive services poorly. Because many private payers adapt the Medicare physician fee schedule to pay providers, these distortions spread broadly through markets. Physicians have responded to these inadvertent payment signals through their choice of specialty and investment in specialized equipment and facilities.

Since the structure of fee-for-service payments will determine the calibration of episode-based payments, distortions in the former will carry over to the latter. So reforms that improve the structure of fee-for-service payment will likewise improve the structure of episode-based payment. Reforming fee-for-service payment is likely to be even more important if an approach to episode-based payment is taken where each provider involved in an episode of care is paid fee for service, with adjustments up or down depending on how total episode costs compare to a benchmark. Moreover, in situations where more efficient treatment in an episode involves a large reduction in relatively lucrative services, physicians may find that the financial reward for achieving greater efficiency per episode is smaller than the loss of profit in fee-for-service payments from reducing lucrative services.

This phenomenon was observed in a study of Virginia Mason Medical Center’s experience working with Aetna’s high-performance network.21 Under pressure to reduce costs per episode in certain specialties, Virginia Mason reengineered its approach to treating episodes of low-back pain. Part of the new approach involved reducing the use of magnetic resonance imaging (MRI) scans to better conform to evidence-based treatment guidelines. MRIs were so lucrative, however, that reducing the volume of MRIs hurt Virginia Mason’s bottom line. Under a system of single payments per episode, reducing the rate of MRIs would improve a provider’s bottom line substantially and reduce the financial pressure providers feel to deliver potentially unnecessary services. However, a transitional system based heavily on fee-for-service payment is highly sensitive to the degree that relative payments track relative costs. Without reform of fee-for-service payment, such a transitional episode-based payment system is unlikely to succeed.

Incorporating Post-Acute Care into Inpatient DRGs

Expanding the scope of DRG payment for inpatient care is essentially a more limited version of episode-based payment and could become a building block for a full-fledged episode-based payment system. For example, consider a hip-replacement episode—bundling of post-acute care would incorporate payment for rehabilitation and associated services into the inpatient DRG payment. An episode-based payment for hip replacement would include these services as well as the surgeon’s and other physicians’ services provided to the patient for that episode. The broader episode payment would need to supersede the inpatient bundle. Initially, a full episode-based payment approach likely would apply to a more limited set of episodes than an expanded-DRG approach. Although it would be operationally challenging, both systems could run simultaneously with episode types included in the episode-based payment approach excluded from the expanded-DRG approach.

Patient-Centered Medical Homes

Typically, under patient-centered medical home (PCMH) initiatives, medical practices that qualify as a patient’s medical home receive capitated payments to supplement fee-for-service payments. The capitated payments cover such services as care coordination and patient education that are not billable under fee for service. Though not necessarily limited to patients with chronic conditions, PCMHs are viewed as a potentially important way to improve care for patients with chronic conditions.

Patient-centered medical homes do overlap with time-based, episode-based payments for managing chronic disease. For an enrollee with a chronic disease, episode-based payment would cover all services associated with the chronic disease during a specified period, in contrast to capitated -PCMH payments that supplement fee-for-service payment. If episode-based payment were established for all major chronic disease and replaced fee-for-service payments, that approach would supersede PCMH payment approaches. However, if episode-based payment instead involved continuation of fee-for-service payments with bonuses and penalties for how monthly fee-for-service payments compare to a benchmark, then the capitated-PCMH payments could continue and episode-based payment would just be an additional incentive to manage care effectively.

Accountable Care Organizations

Accountable care organizations consist of providers voluntarily forming a business relationship to accept some degree of financial risk through capitation or enhanced fee-for-service payments for enrollees attributed to the ACO by a payer.22 Some have advocated “virtual” ACOs that would consist of all providers in a geographic area that have not entered into such a business relationship.

A typical ACO strategy, such as those outlined in proposed health reform legislation, continues fee-for-service payment for services but adds bonuses or penalties based on the efficiency and quality of care enrollees receive over a specified time. ACO incentives could apply to all services for an enrollee or for only a subset of services, such as physician professional services.

Generally, episode-based payment and ACOs are compatible. Episode-based payments would be included in the calculation of total payments per enrollee (the remainder being fee for service) that would be compared to benchmarks to determine rewards or penalties for ACOs. Incorporating payments under episode-based payment instead of pure fee-for-service payment would avoid an inadvertent doubling of rewards or penalties. For example, if providers had low episode costs, they would be rewarded by episode-based payments, but the low costs per episode would not generate an additional reward under the ACO structure. ACOs would earn their reward/penalty for that type of episode based on their ability to control the volume of episodes per enrollee. This compatibility would hold under both arrangements that make full episode-based payments and under fee-for-service payment with bonuses/penalties for efficiency in delivering the episode.

Although some perceive episode-based payment and ACOs as competing payment reforms, pursuing them simultaneously could be viewed as hedging bets on payment reform success. The ACO approach theoretically has more upside because it provides incentives to control episode volume as well as to improve the efficiency of episodes of care. But ACOs face greater risk of falling short because the approach essentially relies on fee for service and the organizational changes required for success are more challenging. So pursuing episode-based payment simultaneously provides some insurance against little success with ACOs.

Implemention of an Episode-Based Payment Program

If payers commit to adopting episode-based payments, a comprehensive implementation strategy is essential and must realistically acknowledge the state of the science and send providers a clear signal about what delivery system changes policy makers wish to promote. Policy makers might strongly consider outlining a cohesive episode-based payment implementation strategy emphasizing a staged approach, in which early phases of the program focus on a narrow set of priority conditions, patients and providers. Such an approach would allow both providers and payers to gather data and experience and make adjustments for a broader, more ambitious later phase.

An Illustrative Snapshot of a Pilot Program

An initial foray into episode-based payments could be sponsored by Medicare, perhaps with a handful of large private payers offering similar payment arrangements to providers who participate in the public pilot. The program would focus on a few episodes for acute conditions common in both elderly and nonelderly populations—for example, CABG surgery and acute low-back pain—and for which payers have historical data suggesting wide variation in per-episode costs.

Under this scenario, the payer announces that in the coming year the operating cardiothoracic surgeon and associated hospital will be accountable for costs of new CABG episodes; and all physicians in the specialties of primary care, rheumatology, orthopedics and neurology treating a patient for acute low-back pain will be accountable jointly for new low-back pain episodes.

For CABG episodes, payers offer a bundled payment based on average historical cost—calculated as a blend of national and local averages—with additional bonuses for meeting quality and efficiency goals. For acute low-back pain episodes, payers continue to pay individual providers fee for service but pay bonuses at the end of the year based on the relative cost and quality performance of all the providers involved in the episode as a whole, compared to local and national averages, as was done for the Medicare ACE demonstration.

As providers become adept at coordinating care in response to these initial incentives, they would formalize collaborations with a widening circle of peers. Some cardiothoracic surgeons might more selectively refer to hospitals with lower-than-average costs and help to implement quality improvement efforts to help patients recovering from a CABG. And in some markets, providers involved in back-pain episodes who happen to already be affiliated with large multispecialty groups could focus on improving internal processes for adhering to recommendations for conservative imaging. For example, they might ask their orthopedic consultants to confirm indications for any procedures with the ambulatory practice when a patient self-refers to a surgeon. In the meantime, payers could collect and provide detailed data on referral patterns and per-episode costs to involved providers. Payers and providers could then negotiate new payment arrangements in the program’s second phase that include bundled payments with financial risk for some episodes—CABG—and without financial risk for others—low-back pain.

The Virtue of Small Steps

A staged episode-based payment program can help providers and payers ensure that current data, analytic and communication systems can support the shift in payment methods. An overly ambitious episode-based payment experiment could alienate patients and/or providers and hobble reform efforts.

A staged approach also gives payers time to analyze and craft solutions for thorny operational issues, such as how to deal with difficult-to-define episodes. Providers also can benefit from limited exposure to episode-based payment incentives as they assess their performance and initiate clinical practice changes to improve performance. Even those committed to improving care coordination and efficiency will have to substantially redesign how they work to achieve those goals.

Focus on Priority Episodes

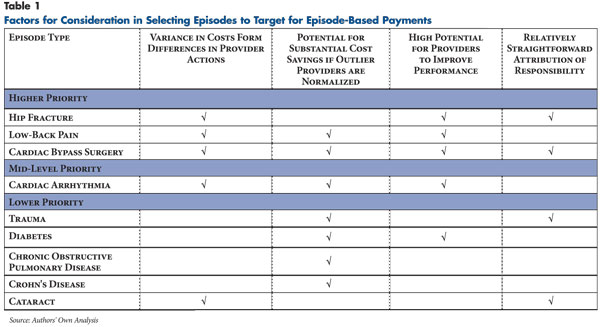

In early stages of an episode-based payment program, payers could focus on a small number of types of episodes that are relatively straightforward to define, measure and attribute and have the greatest potential for cost savings. Later program stages could expand to target more complex episodes and constellations of providers. Technical features that improve the feasibility of applying an episode type include:

- Episodes where payers can measure cost variance and where a meaningful percentageis believed to result from differences in provider behavior

- rather than differences in patients’ clinical complexity or unpredictable disease progression (see Table 1). For example, providers have significant discretion over the types of diagnostic tests to use for a patient complaining of back pain, which contributes to wide variation in the costs of such episodes.23 In contrast, costs for an episode of head trauma are more likely to be driven by differences in the severity of the patient’s injury.

- Episodes that could generate substantial cost savings if outlier providers responsible for the highest-cost episodes could improve their performance. For example, providers have a great deal of discretion over the diagnostic tests they use for a patient complaining of heart palpitations.

- Episodes involving care decisions where there are clear standards to help providers improve their performance. For example, many professional organizations have best practices for the care of patients undergoing surgery in general and cardiac bypass in particular.

- Episodes where it is relatively straightforward to identify one or more providers with substantial influence over decisions that drive costs—generally this means that acute episodes will be easier to attribute than chronic ones. For example, the orthopedic surgeon who repairs a patient’s acute hip fracture clearly has substantial influence over care decisions for that episode. In contrast, costs for an episode of congestive heart failure could be more evenly influenced by several providers, such as a patient’s cardiologist, nephrologist and primary care physician.

De-Couple Payments for Service Delivery from

Payments for Performance

As discussed previously, payers can structure episode-based payments in one of two general ways:

- Bundle payments for all care a patient receives for a particular condition over a specified period or for services triggered by a specific diagnosis, which requires the insurer to define the end-point of the episode; or

- Less ambitious approaches that retain fee for service as the core payment but add bonuses and/or withholds based on the provider’s efficiency of treating the episode of care.

Bundled payments give providers the strongest incentive to coordinate care and improve efficiency but put providers at substantial financial risk for some factors outside their control. Bundled payment rates, if built up from the expected costs for recommended services for a given condition—such as in the PROMETHEUS approach—would also have to rely on a relatively sparse evidence base in terms of the appropriate costs for many services.

Another challenge would be preventing double billing by different providers that care for the same patient during an episode of care spanning multiple facilities—only one of which may be receiving the bundled payment—without restricting the patient’s choice of providers. Lastly, bundled payments for an acute episode can be vulnerable to so-called upcoding—or reporting a higher level of patient acuity. And, in the case of ambulatory care episodes involving more than one provider, bundled payments would be more difficult to audit than an inpatient stay.

Fee-for-service systems may offer payers more flexibility at the start of an episode-based payment program, particularly if payments for service delivery are de-coupled from payment for efficiency performance, as described above. This approach clearly results in weaker incentives to rein in costs than bundled payments but could moderate providers’ financial risk to a manageable level as they acclimate to the incentives of episode-based payments. Payers also would have time to collect claims data to better set benchmarks for assessing providers’ relative efficiency performance. In subsequent stages, payers could use such data to set prospective payments for episodes based on the experiences of higher-performing physicians. And patients would perceive less of a threat to their free choice of providers.

Sticks or Carrots to Participate?

Mandatory participation in an episode-based payment program suggests that payers will identify the responsible provider(s) and tell them either prospectively or retrospectively which patients and episodes they are responsible for, since it would be far less feasible to ask all providers to identify their own patients in a broad program. Mandatory participation also would provide payers with more comprehensive data on per-episode costs to support the development of bundled payments for later phases. The main disadvantage of mandatory participation is that it essentially limits payers to applying fee-for-service payments, because most providers currently do not work in organizations capable of accepting the financial risk associated with bundled payments. Moreover, the fragmented and competitive nature of current provider markets poses substantial barriers to effective collaboration for many providers.24

In a voluntary program, payers could allow the smaller number of participating providers to identify their own patients prospectively, which may increase provider buy in but also increase the risks of “cream-skimming” and “lemon dropping” if providers try to assume responsibility for less-costly patients and avoid more costly ones. Payers could mitigate this risk by involving patients in confirming who their primary provider is. Payers could also face some fiscal risk, since providers that volunteer would probably already have lower-than-average costs per episode than non-volunteers.

Medicare’s Role

While private payers might be more nimble in experimenting with episode-based payments, fee-for-service Medicare is the dominant payer in many health care markets, giving Medicare an important role in any broad payment-reform effort. Moreover, at present Medicare is the only payer with sufficient historical data on large populations of providers to reliably benchmark their relative efficiency performance. Programmatically, developing episode-based payments also is consistent with related CMS efforts to profile individual physicians on their per-capita and per-episode cost performance, demonstrations of bundled payments, and exploration, along with the Medicare Payment Advisory Commission, of payments to accountable care organizations.25

However, one potential conflict between episode-based payments and other payment approaches is limited implementation resources, particularly at CMS. Given the increased interest in provider-payment reform and the fact that it is one of the few tools available to government to restructure the health care delivery system, easing these resource constraints is essential. CMS also could reap economies in implementing reforms to the extent that the agency can harmonize payment approaches with private payers in a given market. Doing so would send consistent signals to providers and increase the likelihood that providers will respond in desired ways.

Bringing Patients into the Process

Payment reform discussions, especially in Medicare, appear to go to great lengths to avoid involving patients. Policy makers, however, unnecessarily limit the potential impact of payment reforms by making them invisible to patients and may even risk a backlash. One way to engage patients would be to provide incentives for them to favor more efficient and higher.